Getting My Home Equity Loan copyright To Work

Table of ContentsTop Guidelines Of Home Equity Loan copyrightThe smart Trick of Home Equity Loan copyright That Nobody is Talking AboutThe Main Principles Of Home Equity Loan copyright

Your monetary organization will usually add this amount to your impressive home loan equilibrium. Determine which type of car loan best matches your demands.

Most major economic institutions use a HELOC combined with a home mortgage under their very own brand name. It integrates a revolving HELOC and a fixed term home loan.

You need to make regular settlements on the home loan principal and passion based on a timetable (Home Equity Loan copyright). The credit history limitation on a HELOC combined with a mortgage can be an optimum of 65% of your home's acquisition price or market price. The quantity of credit history readily available in the HELOC will certainly rise to that credit score limit as you pay down the principal on your home mortgage

These different loans and credit score items can have various rate of interest and terms than your HELOC. You can likewise use your HELOC to pay down financial debts you have with other lenders. It is necessary to be disciplined when utilizing a HELOC incorporated with a home loan to stay clear of handling even more financial obligation than you can afford to pay back.

Top Guidelines Of Home Equity Loan copyright

You can also settle the whole balance at any time without paying an early repayment fine. A home equity lending is different from a home equity credit line. With a home equity financing, you're offered an one-time round figure repayment. This can be as much as 80% of your home's value.

The loan isn't revolving credit score. After you're approved, you can access your HELOC whenever you want. You'll need: a minimum down settlement or equity of go to this website 20%, or a minimum down settlement or equity of 35% if you want to make use of a stand-alone HELOC as a replacement for a home loan Before accepting you for a HELOC, your lending institution will likewise need that you have: an appropriate credit history rating evidence of sufficient and stable income an appropriate level of debt compared to your revenue To qualify for a HELOC at a financial institution, you will certainly require to pass a "stress test".

9 Simple Techniques For Home Equity Loan copyright

Read the official statement conditions carefully and ask questions if there's anything you do not understand before buying these products. Before you obtain optional credit insurance coverage: check if you already have insurance policy protection via your employer to repay your debts in situation of death or special needs contrast the insurance coverage supplied by various other insurance items, such as life and medical insurance, to see which product satisfies your needs and uses the ideal value Determine whether you require added debt to accomplish your goals or can you construct and utilize savings instead If you determine you need credit, consider points like adaptability, costs, rate of interest prices and terms and problems Make a clear plan of just how you'll make use of the cash you obtain Develop a practical allocate your jobs Identify the credit line you require Search and bargain with various loan providers Create a payment routine and stick to it A HELOC might or may not serve to you.

Rider Strong Then & Now!

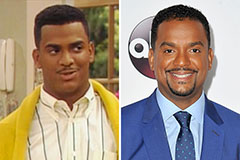

Rider Strong Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now!